June 2020

The ongoing COVID-19 pandemic has resulted in a tragic loss of life around the world and turmoil in global capital markets and economies. According to a number of prominent economists, the government-mandated stay-at-home orders have effectively shut down economic activity around the globe, potentially resulting in the worst global recession since World War II. This broad economic slowdown has resulted in substantial volatility in the capital markets, which has been further exacerbated by the absence of a definitive date as to when the world may return to relative normalcy. From a financial reporting perspective, it is likely that companies will need to consider whether or not these factors, when considered in aggregate with individual performance and outlook, constitute a “triggering event” that would impact the fair value of their underlying assets and equity. This is a potentially wide-reaching accounting and valuation issue, even for those companies that have elected to amortize their assets instead of testing for impairment on an annual basis.

Impairment testing is performed based on the guidance provided by Accounting Standards Codification Topic (“ASC”) 350. The first step is a qualitative assessment (frequently referred to as Step 0; refer to ASC 350-20-35-3), which requires filers to assess whether or not it is “more likely than not” that the fair value of a reporting unit is less than its carrying amount (book value). The guidance provides some examples of circumstances that would require a reassessment of the equity value of a company, including deterioration in macroeconomic, industry, and market conditions or adverse changes in financial performance, among others (refer to ASC 350-20-35-3C). When it is “more likely than not” that a reporting unit may be impaired, quantitative testing is required (Step 1 impairment testing).

Does this apply to your company/client?

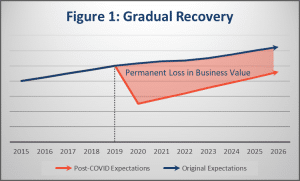

Whether or not you or your client needs to be concerned about a potential triggering event will depend on individual facts and circumstances. For some businesses, identifying the need for Step 1 impairment testing may be somewhat obvious. As an example, a business that has experienced a significant decline in revenue or profitability in 2020 due to reasons related to COVID-19 and expecting a slow subsequent recovery will be more likely to experience impairment in goodwill (and possibly other assets on the balance sheet). It is important to understand that whether or not a business’ goodwill is impaired will depend significantly on the current expectations of the business relative to expectations that existed when establishing the balance of goodwill. As graphically depicted in Figure 1, a prolonged impact from COVID-19 on a business would suggest a permanent loss in value, which should be measured via a goodwill impairment analysis. In this case, an assessment to determine whether or not impairment exists in the underlying long-lived assets (ASC 360) will also be required.

Whether or not you or your client needs to be concerned about a potential triggering event will depend on individual facts and circumstances. For some businesses, identifying the need for Step 1 impairment testing may be somewhat obvious. As an example, a business that has experienced a significant decline in revenue or profitability in 2020 due to reasons related to COVID-19 and expecting a slow subsequent recovery will be more likely to experience impairment in goodwill (and possibly other assets on the balance sheet). It is important to understand that whether or not a business’ goodwill is impaired will depend significantly on the current expectations of the business relative to expectations that existed when establishing the balance of goodwill. As graphically depicted in Figure 1, a prolonged impact from COVID-19 on a business would suggest a permanent loss in value, which should be measured via a goodwill impairment analysis. In this case, an assessment to determine whether or not impairment exists in the underlying long-lived assets (ASC 360) will also be required.

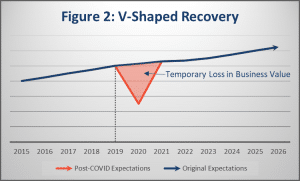

In other businesses, such as depicted in Figure 2, the recent decline in revenue or profitability may be temporary and, therefore, have a lesser impact to overall business value. In these cases, the need for impairment testing may not be as evident. In addition, since temporary declines in pricing do not necessarily suggest an impairment event, important consideration should be given to all factors relevant to the business and its operations, as well as general market conditions. This is particularly important for public companies that may have experienced a decline in market capitalization due to reduced investor sentiment, but have not necessarily seen a corresponding decrease in business fundamentals (i.e., projected growth, profitability, liquidity, leverage, etc.). These factors are considered when performing a Step 1 impairment test.

In other businesses, such as depicted in Figure 2, the recent decline in revenue or profitability may be temporary and, therefore, have a lesser impact to overall business value. In these cases, the need for impairment testing may not be as evident. In addition, since temporary declines in pricing do not necessarily suggest an impairment event, important consideration should be given to all factors relevant to the business and its operations, as well as general market conditions. This is particularly important for public companies that may have experienced a decline in market capitalization due to reduced investor sentiment, but have not necessarily seen a corresponding decrease in business fundamentals (i.e., projected growth, profitability, liquidity, leverage, etc.). These factors are considered when performing a Step 1 impairment test.

Helios Consulting can assist you in navigating through both the Step 0 and Step 1 impairment testing process. Click here to view our impairment testing capabilities or contact us for a consultation.